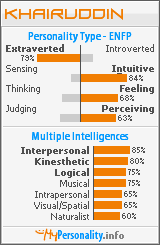

Muhammad Khairuddin Bin Ahmad

0920597

In economics technically Zakat defined as a “transfer payment” which Sahib-e-Nisab muslim pay to poor given rate in the month of RAJAB.

Many societies allocate a part of the income raised from their financially well off sections to support the poor and deprived segments of society. They tax the rich and spend this money on the poor. For example, in the United States nearly 13% of total personal income in the year 2000 came from transfer payments (Bureau of Economic Analysis, Washington DC). A transfer payment is a payment to a person for which that person has not rendered any service. A large section of transfer payments are made to very poor because either they are unemployed or their income is very low.

In the Muslim society, from the very beginning, believers were motivated and encouraged to allocate a part of their earnings for the uplift of poor. Some very early revelations (Al Qur’an 51:19 and 71:24 & 25) in Makkah motivate believers to assign a due share (Haqqul Maloom) of the needy and deprived in their possessions. In Madina, when a Muslim society had finally emerged, wealthy sections of this society were made responsible for improving the living conditions of the poor and deprived people. Share of the poor and deprived segments in the wealth of well-off Muslims was specified in the form of Zakat rates and Zakat payments were made compulsory for every rich Muslim. Laws for collection of Zakat were enacted and heads of expenditure were specified.

In above paragraph, we understand that transfer payment is a payment of people who got a money and give it to society whether the receiver is unemployed or low income. But different with zakat. Zakat had already stated by Allah s.w.t in quran and hadith about the asnaf which is the receiver of the zakat. Not only for poor but also for mu’alaf, amil and so on. And the purpose of zakat is not only give benefit to the receiver but also to those who give the zakat. In Al-Quran Allah stated that zakat is to purify soul such stated in Al-Quran. It also an obligatory payment that must be paid by a muslim who had wealth to give to others.

0920597

Is Zakat Tranfer Payment?

In economics technically Zakat defined as a “transfer payment” which Sahib-e-Nisab muslim pay to poor given rate in the month of RAJAB.

Many societies allocate a part of the income raised from their financially well off sections to support the poor and deprived segments of society. They tax the rich and spend this money on the poor. For example, in the United States nearly 13% of total personal income in the year 2000 came from transfer payments (Bureau of Economic Analysis, Washington DC). A transfer payment is a payment to a person for which that person has not rendered any service. A large section of transfer payments are made to very poor because either they are unemployed or their income is very low.

In the Muslim society, from the very beginning, believers were motivated and encouraged to allocate a part of their earnings for the uplift of poor. Some very early revelations (Al Qur’an 51:19 and 71:24 & 25) in Makkah motivate believers to assign a due share (Haqqul Maloom) of the needy and deprived in their possessions. In Madina, when a Muslim society had finally emerged, wealthy sections of this society were made responsible for improving the living conditions of the poor and deprived people. Share of the poor and deprived segments in the wealth of well-off Muslims was specified in the form of Zakat rates and Zakat payments were made compulsory for every rich Muslim. Laws for collection of Zakat were enacted and heads of expenditure were specified.

In above paragraph, we understand that transfer payment is a payment of people who got a money and give it to society whether the receiver is unemployed or low income. But different with zakat. Zakat had already stated by Allah s.w.t in quran and hadith about the asnaf which is the receiver of the zakat. Not only for poor but also for mu’alaf, amil and so on. And the purpose of zakat is not only give benefit to the receiver but also to those who give the zakat. In Al-Quran Allah stated that zakat is to purify soul such stated in Al-Quran. It also an obligatory payment that must be paid by a muslim who had wealth to give to others.